The Central Statistics Office (CSO) has published the results of the Pensions Survey which was carried out in Quarter 3 (July to September) of 2021.

Commenting on the report, Maureen Delamere, Statistician said:

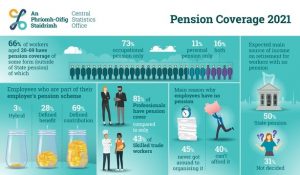

“The results in this publication cover pension provision outside of the State pension. Of persons in employment in Quarter 3 2021, around two-thirds (66%) had pension coverage of some form (outside of the State pension), up one percentage point from 2020.

Pension coverage in 2021 followed the same trend as in 2020 where pension coverage was lowest among younger workers. Just over a quarter (25%) of workers in the 20 to 24 years age group had pension coverage. Supplementary pension coverage increases with age, with almost 74% of the oldest age group surveyed, persons aged 55-69 years, having supplementary pension cover. Most supplementary pension cover is with defined contribution (69% of pensions) rather than defined benefit (28% of pensions).

Nearly half (47%) of older workers aged 55 to 69 years have been in their current occupational pension scheme for 20 years or more, compared with just over one in 12 (9%) of persons aged between 35 and 44 years.

Analysis of pension coverage by broad occupational groups shows that workers whose occupation was classified as “Professionals” had the highest pension coverage rate (81% of persons working in this area), whereas, just over four in 10 (43%) of workers whose broad occupational group was “Skilled trades” had pension coverage. The economic sector with the highest pension coverage in Quarter 3 2021 was “Public administration & defence; compulsory social security” (95%).

Of employees who had no supplementary pension cover, 40% cited the affordability of pensions as the main reason for not having pension cover, while a further 45% stated that they never got around to organising it or would organise pension provision at a future date.

For workers (including self-employed), the State Pension was cited as the expected main source of income on retirement for half (50%) of workers with no pension coverage, while more than three in 10 (31%) had not yet decided on this issue.”

- In Quarter 3 2021, pension coverage remained lowest among younger workers – one quarter (25%) of workers aged 20 to 24 years had a pension, up one percentage point from 2020 (24%)

- Pension coverage was greatest among workers aged 45 to 54 years where more than three-quarters of persons in employment (77%) had supplementary pension coverage

- For employees with occupational pensions from their current employment, the number with ‘defined benefit’ pensions decreased in 2021 (28% compared with 34% in 2020), while the number with ‘defined contribution’ pensions increased to 69% from 64% in 2020

- For those workers with no occupational pension coverage from their current employment, more than half (53%) stated that their employer does not offer a pension scheme

- Of employees with no supplementary pension cover, four in 10 (40%) cited affordability as the main reason, while 45% stated that they never got around to organising it or would organise it at a future date

- The State Pension was cited as the expected main source of income on retirement for almost 50%of workers with no pension coverage, while more than three in 10 (31%) had not yet decided what their main source of income would be